EDUCASH – Financial Education

Millennials are better educated than their predecessors, more ethnically

diverse, and more economically active. Millennials confront greater

difficulties — including economic uncertainty, student debt—than those

who came before them. As a generation carrying new personal financial

responsibility, it is critically important for Millennials to be on a path

leading toward financial security. Yet, research indicated that only 24%

of Millennials demonstrated basic financial knowledge, and majority

were very unsatisfied with their current financial situation. With all

things said, when facing such critical condition, only 27% of Millennials

are seeking professional financial advise on saving and investment. Lack

of financial knowledge may jeopardize millennials’ financial success.

Therefore, manifestation of this event is to bring awareness to those

younger millennials to make the same mistake is the second priority and

more importantly to encourage school board to include financial literacy

as part of the curriculum.

Steffenhagen, J. (2019). Canada’s education system is failing. Vancouver Sun.

Campaign Posters

EDUCASH Brand Book

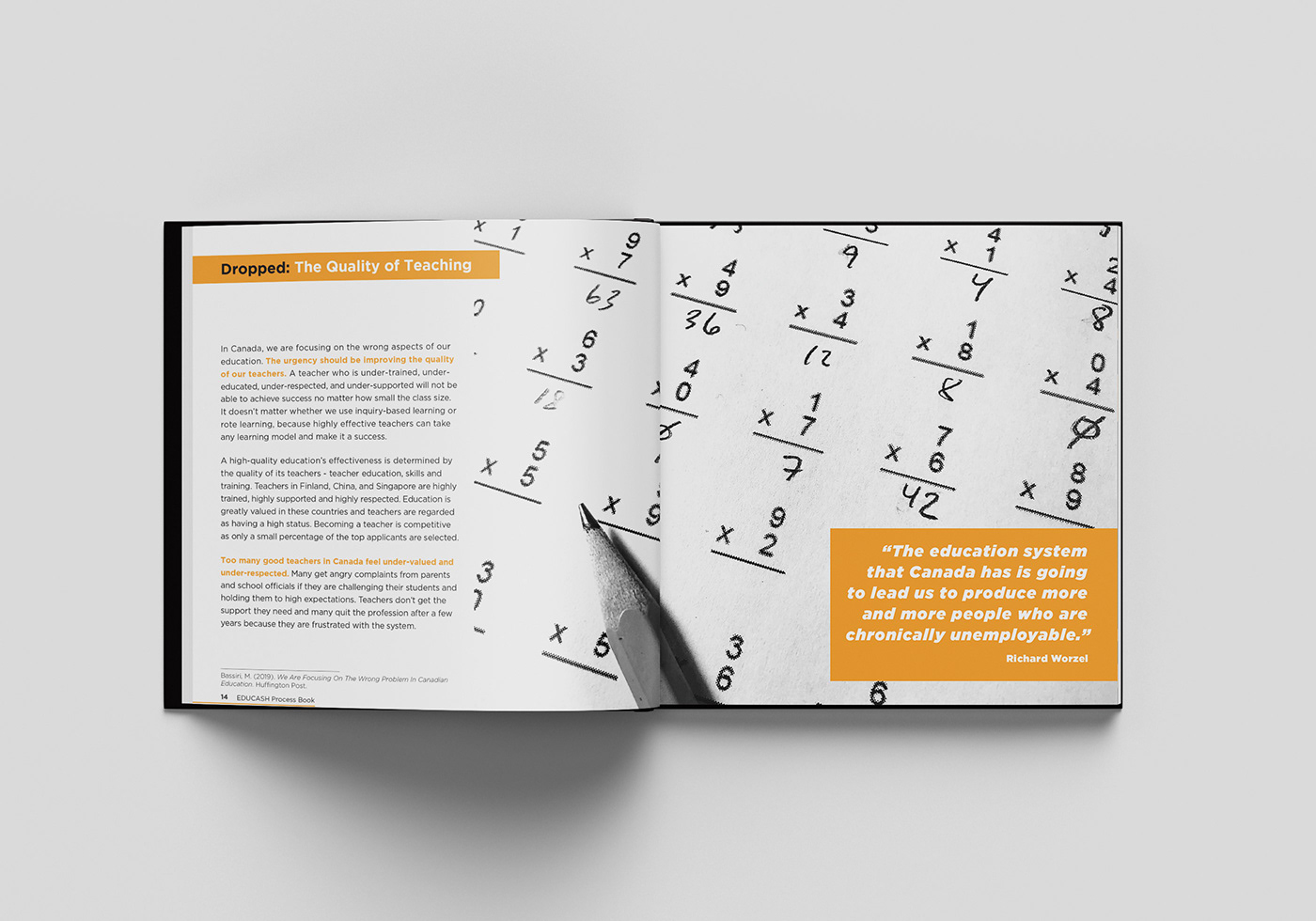

Although Canada has had some educational success, it appears to be

headed for a national knowledge disadvantage, the CCL report says.

“Unlike Canada, competitor countries have developed, or are in

the process of developing, coordinated approaches to education

and lifelong learning,” CCL president Paul Cappon states in a release.

The report acknowledges the successes of the Canadian education

system, including the solid performance of students in international

tests, declining drop-out rates and growing numbers of aboriginal

students completing high school and continuing with post-secondary

education. But says that despite those positives, “there are also signs

of systemic weakness that, if left unchecked, will inhibit Canada’s

capacity to grow and prosper. Indeed, Canada cannot claim to be

a learning society until we have confronted the many learning

paradoxes that undermine further progress.”

Steffenhagen, J. (2019). Canada’s education system is failing. Vancouver Sun.

WHY?

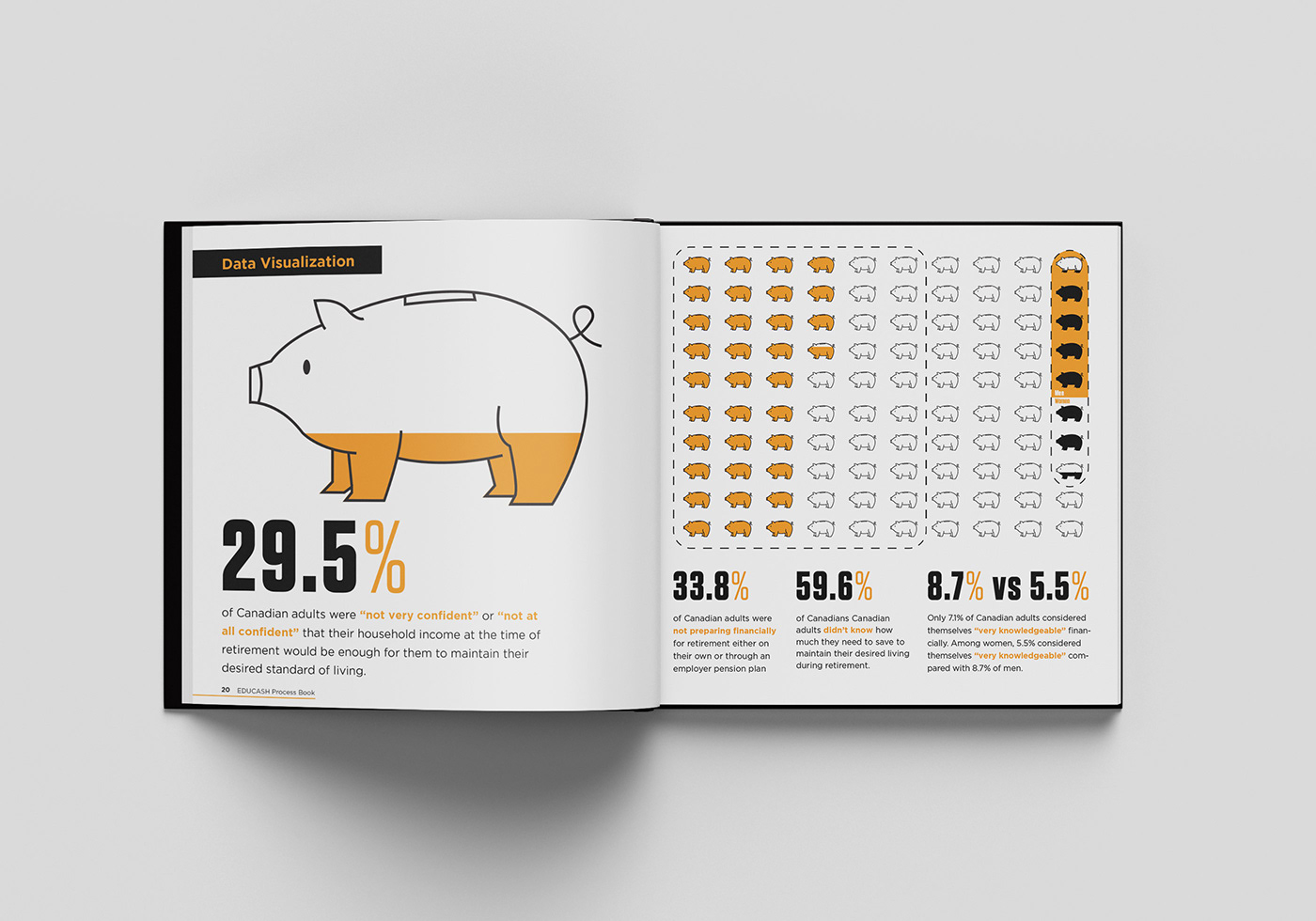

Millennials, the target group, growing and gradually becoming independent,

they need to know that finance is a big part of life, lack in education, could

result in a catastrophic bankrupt, loan, and sad elder life. Each Year, students

spending an average of $4,321 to pay back credit cards, personal loans, and

student debt over the course of their degree. As research indicates, millennials

are historically under-payed and tend to purchase more expensive goods in

the market. However, only 24% of the young millennial generations are

considered well knowledgeable when it comes to financial literacy. For

millennial, debt free is considered as a success.

WHAT?

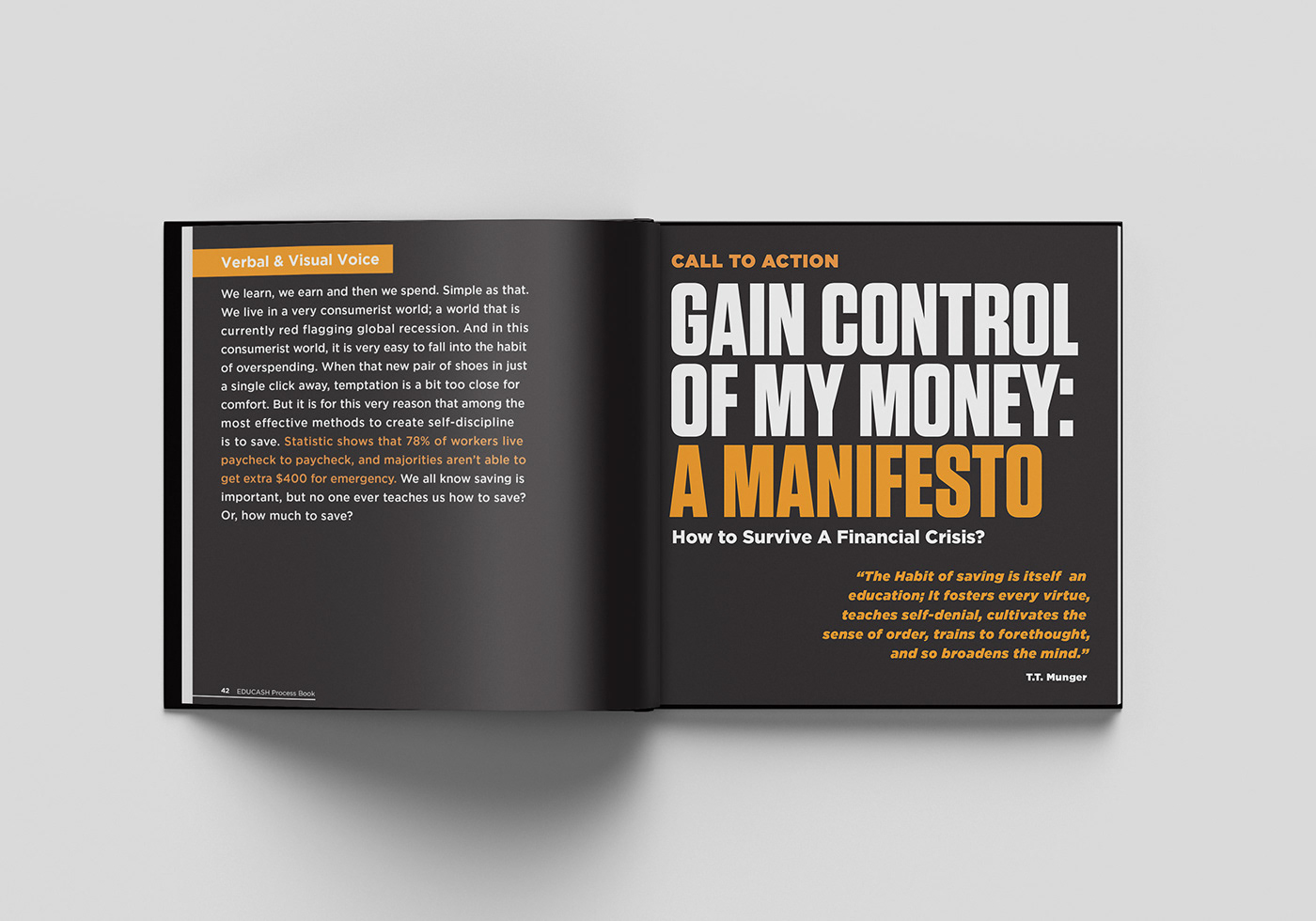

Situation is, the negative financial cycle occurring to millennials is not just

about a over-spending lifestyle. Down to earth, it is about finding balance

between a healthy lifestyle and saving. However, not many people can realize

that is the small things that really matters in finances. Know how to make a

healthy financial decision is the first step for people who want to break out of

the pay-check to pay-check cycle.

HOW?

Curating a event for millennial generation, explain in-depth on the reasoning

Curating a event for millennial generation, explain in-depth on the reasoning

and consequences of financial illiteracy. Providing them a solution by expanding

access to financial education with a forward-looking approach to financial

literacy. Starting by school, education systems should provides an opportunity

to shift future generations’ financial positions, giving them a solid base from

which to make life’s important financial decisions. Millennial should start self

evaluate their own financial standing, and learn more financial knowledge to

gain a greater aspect on personal finance.

After a in-depth research on how currently Canadian financial system

is facing critical vulnerabilities, and how personal finance problem can

reflect on personal and social aspects. We realize that financial literacy

matter need to be communicated in a serious tone. We aim to bring

awareness and attentions to people, and let them deeply contemplate

over their own financial knowledge. Because, without an understanding

of basic financial concepts, people are not well equipped to make

decisions related to financial management. People who are financially

literate have the ability to make informed financial choices regarding

saving, investing, borrowing, and more.

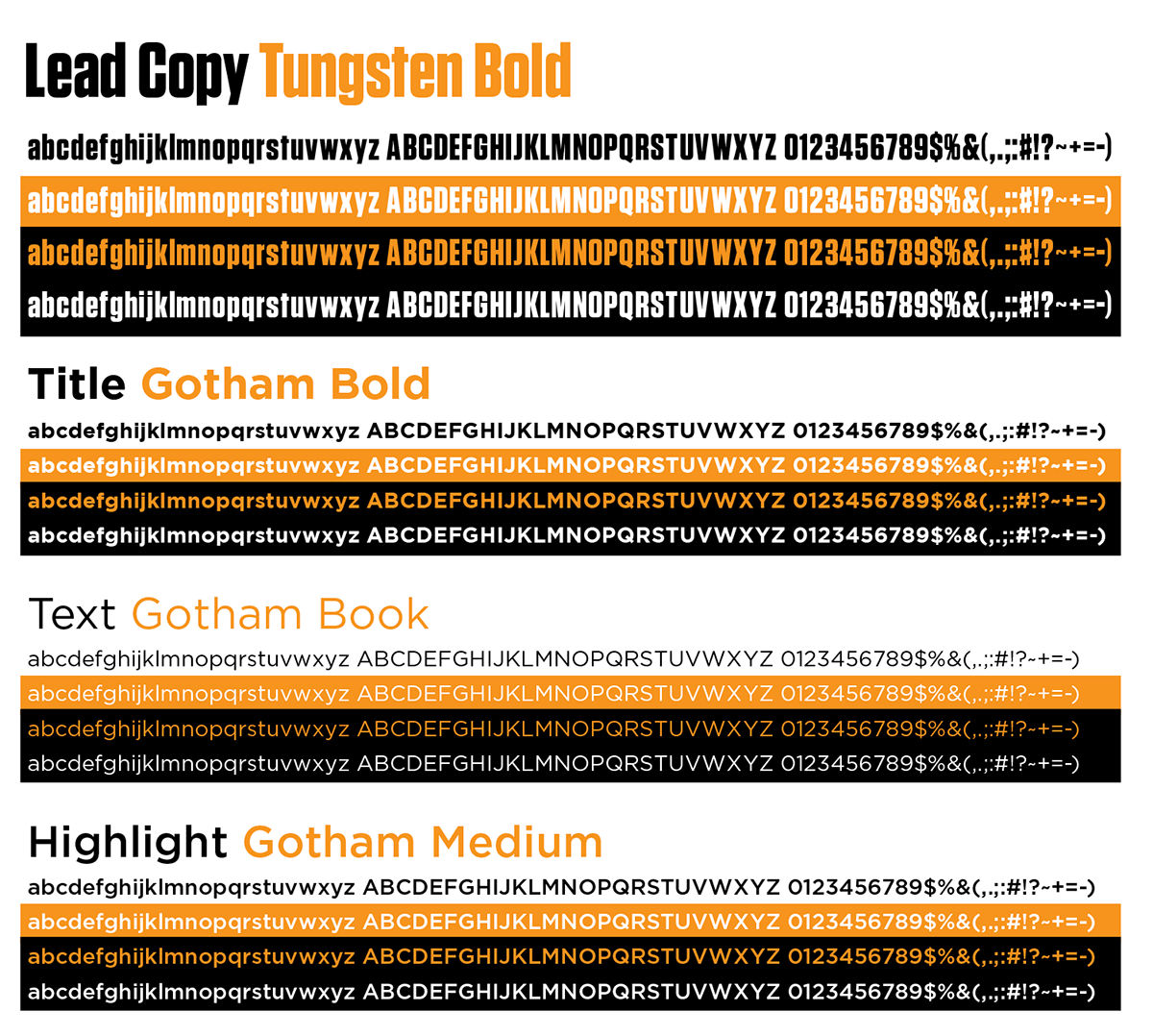

Fonts: Tungsten Bold & Gotham Bold Family

EDUCASH – Financial Literacy

Instructed by Frederick Burbach

Designed by Ruizhou Li, Jenny Hwang & Greg Donnato

GRAPHIC DESIGN WORKSHOP 2019